Westside Observer

Westside Observer

April 2015 at www.WestsideObserver.com

November 2015 Housing Bond Ballot Measure

Mayor’s Housing Scam, Redux

Article in Press Printer-friendly

PDF file

Westside Observer

Westside Observer

April 2015 at www.WestsideObserver.com

November

2015 Housing Bond Ballot Measure

Mayor’s

Housing Scam, Redux

by Patrick Monette-Shaw

When San Francisco Mayor Ed Lee rolls out his $250 million general obligation bond measure for the November 2015 election, don’t say you haven’t been warned to vote against it.

A year ago I covered Mayor Ed “Affordability Mayor” Lee’s housing bait-and-switch in April 2014. Redux, he’s brought back Olson Lee, Director of the Mayor’s Office of Housing and Community Development (MOHCD), again. What a pair!

In 2012 voters handed the Mayor creation of the Housing Trust Fund, which will divert $1.5 billion in general fund revenues to the Housing Trust Fund over the next 30 years. Apparently the $1.5 billion isn’t enough, and three years later the Mayor is back, hat in hand, asking for another $250 million bond measure and $100 million from the City employee’s retirement fund, pushing the combined total to nearly $2 billion.

$1.5 Billion Housing Trust Fund “Leveraged” as Collateral for Bonds

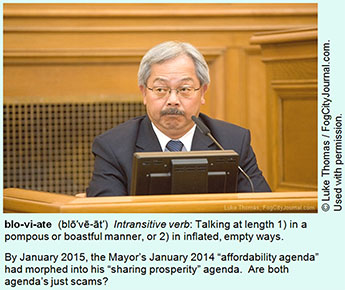

Voters were not told

prior to the November 2012 election that the $1.5 billion Housing

Trust Fund would be “leveraged.” Although the Mayor

wants voters to approve the November 2015 $250 million general

obligation bond, it is highly unlikely that the Mayor will tell

voters prior to November 2015 that during 2014 he approved issuing

bonds against the $1.5 billion Housing Trust Fund, using the trust

fund as collateral. According to page 5 in MOHCD’s annual report for FY 2012-2013 and FY 2013-2014:

Voters were not told

prior to the November 2012 election that the $1.5 billion Housing

Trust Fund would be “leveraged.” Although the Mayor

wants voters to approve the November 2015 $250 million general

obligation bond, it is highly unlikely that the Mayor will tell

voters prior to November 2015 that during 2014 he approved issuing

bonds against the $1.5 billion Housing Trust Fund, using the trust

fund as collateral. According to page 5 in MOHCD’s annual report for FY 2012-2013 and FY 2013-2014:

Investopedia.com defines “leveraging” as an investment strategy of using borrowed money to generate investment returns. If an investor uses leverage to fund an investment and the investment suffers a loss, the investor’s loss is much greater than it would’ve been if the investment had not been leveraged, since leverage magnifies both gains and losses. Leverage has the potential to enlarge investment profits or losses by the same magnitude. The greater the amount of leverage on capital applied, the higher the risk that is assumed.

There you have it: The Mayor is using the Housing Trust Fund as credit card debt to float bonds, with no public oversight of the bond funding terms and details, and no oversight of what the bonds will be used for, without approval by the voters. What is this? A raid of the general fund to float bonds?

No Plans to Build Middle-Income Housaing

Despite the Mayor’s

assertions that he has a plan to address the housing crisis in

San Francisco (presumably including for the middle-class), Olson

Lee admitted during a public meeting that the middle class apparently

aren’t in the plan. As Jon Golinger’s op-ed article “Voter’s revolt is

two decades in the making” published in the San Francisco

Examiner on March 15, 2015 reported, when asked about City

Hall’s plans to create desperately needed middle-class rental

housing, Olson Lee replied, “We don’t have a program

right now to build middle-income rental housing.” At last,

a candid admission.

Despite the Mayor’s

assertions that he has a plan to address the housing crisis in

San Francisco (presumably including for the middle-class), Olson

Lee admitted during a public meeting that the middle class apparently

aren’t in the plan. As Jon Golinger’s op-ed article “Voter’s revolt is

two decades in the making” published in the San Francisco

Examiner on March 15, 2015 reported, when asked about City

Hall’s plans to create desperately needed middle-class rental

housing, Olson Lee replied, “We don’t have a program

right now to build middle-income rental housing.” At last,

a candid admission.

Olson Lee reportedly said this twice during a community meeting on February 26, 2015 in a Port of San Francisco headquarters meeting room at Pier 1 regarding ongoing discussions between the Port, the Mayor’s Office of Housing, and the community regarding a proposed housing project for Seawall Lot 322-1 at the corner of Front and Broadway near the waterfront. Hopefully, another waterfront development fight will not obscure the Mayor’s housing scam redux.

The production of

affordable housing in San Francisco during the past seven years

has been deplorable, according to an op-ed Supervisor David Campos

published in the San Francisco Examiner

on February 25, 2015, titled “It’s still called trickle-down

economics, even in San Francisco.” Campos noted that over

the last seven years, 23,000 luxury units have been built in San

Francisco compared to just 1,200 units for middle-class families;

Lee has been mayor for three-and-a-half of those seven years.

The production of

affordable housing in San Francisco during the past seven years

has been deplorable, according to an op-ed Supervisor David Campos

published in the San Francisco Examiner

on February 25, 2015, titled “It’s still called trickle-down

economics, even in San Francisco.” Campos noted that over

the last seven years, 23,000 luxury units have been built in San

Francisco compared to just 1,200 units for middle-class families;

Lee has been mayor for three-and-a-half of those seven years.

A February 23, 2015 article on PeoplePowerMedia.net, titled “5 Facts: San Francisco’s Housing Crisis is NOT Because of Supply,” indicates that between 1950 and 2013 “Over these 63 years, SF’s population has increased by only 62,085, while we’ve added 115,245 new housing units.” The web site didn’t stratify how many of the 115,245 housing units built were market-rate, affordable, below-market rate, or were for middle-class families. Nor did the web site indicate how many housing units may have been lost from having been taken off of the market during the same period.

Mayor’s Proposed 2015 Housing Bond

Mayor’s Proposed 2015 Housing Bond

When the Mayor delivered his “sharing prosperity” agenda during his January 15, 2015 State-of-the-City speech, his staff issued a press release that, in part, announced an “Affordable Housing Bond” for the November 2015 municipal ballot. The press release claims:

Elsewhere, the Mayor’s public relations staff have been promoting this bond measure, but have claimed it will be for low- to middle-income housing, with no mention that the bond is intended to rebuild public housing for the successor agency to the San Francisco Redevelopment Authority. The bond will likely downplay that it will rebuild public housing.

\ unding of various

categories of housing is tied to formulas based on area median

income (AMI). The Mayor’s Office of Housing publishes an

annual chart

listing various percentages of AMI. MOHCD defines the middle class

as those earning between 80% and 150% of AMI, which translates

to between $57,100 to $107,050 for a single-person household,

and between $73,350 to $137,550 for a three-person household.

unding of various

categories of housing is tied to formulas based on area median

income (AMI). The Mayor’s Office of Housing publishes an

annual chart

listing various percentages of AMI. MOHCD defines the middle class

as those earning between 80% and 150% of AMI, which translates

to between $57,100 to $107,050 for a single-person household,

and between $73,350 to $137,550 for a three-person household.

By contrast, extremely low- to low-income households are defined by MOHCD as earning between 20% to 80% of AMI, which translates to between $14,250 to $57,100 for a single-person household, and between $18,350 to $73,350 for a three-person household. Also by way of contrast, upper-income households are defined as earning between 150% and 200% of AMI, which translates to between $107,050 to $142,700 for a single-person household, and between $137,550 to $183,400 for a three-person household.

MOHCD’s Plan for Bond Use: Option 1

A series of e-mails obtained under public records requests includes a chart showing that as of January 27 2015 the Mayor’s Office of Housing had proposed one set of planned uses for the $250 million bond, including allocating $166 million (66% of the bond) for approximately 710 low- to middle-income housing units (52.2% of the proposed 1,360 units), just $70 million for 350 middle-income housing units (25.7% of the 1,360 units), and $15 million for 300 upper-income housing units (22% of the 1,360 units) for households that conceivably earn up to $203,800 of area median income for a family of four (or up to $142,700 for a single person).

As the first proposed

uses of the bond document indicates, why is a general obligation

bond to rebuild public housing proposing to set aside funds to

build 300 units of upper-income housing for three-person households

who may earn up to $183,400 (200% of AMI), or higher?

As the first proposed

uses of the bond document indicates, why is a general obligation

bond to rebuild public housing proposing to set aside funds to

build 300 units of upper-income housing for three-person households

who may earn up to $183,400 (200% of AMI), or higher?

Of the $166 million targeted for 710 low- to middle-income housing units, $20 million (12.1% of the $166 million or 8% of the total $250 million bond) was listed in the table as being for a “Catalyst Fund Top Loss” program providing 100 units of housing for low- to middle-income housing. The Catalyst Fund is a problem in its own right.

Interestingly, the e-mailed table outlining MOHCD’s proposed uses of the bond was revised at least once on January 27 between 1:04 p.m. and 5:07 p.m. in anticipation of a meeting, and the allocation mix may have changed since then.

Mayor’s Budget Director’s Plan for Bond Use: Option 2

A week after MOHCD’s

January 27 proposal was e-mailed to various staff, the Mayor’s

Budget Director proposed a different allocation of the bond during

a meeting with the Mayor on February 3. An extract from a presentation

to the Mayor a week later on February 3 shows a second proposal that reveals a different picture

of the planned use of the $250 million bond. For starters, while

MOHCD proposed spending $30 million to accelerate and shorten

the HOPE SF housing program schedule from 20 years to 17 years,

the Mayor’s Budget Director’s presentation proposed

spending $80 Million on the same acceleration of HOPE SF. So which

is it: $30 million, or $80 million?

A week after MOHCD’s

January 27 proposal was e-mailed to various staff, the Mayor’s

Budget Director proposed a different allocation of the bond during

a meeting with the Mayor on February 3. An extract from a presentation

to the Mayor a week later on February 3 shows a second proposal that reveals a different picture

of the planned use of the $250 million bond. For starters, while

MOHCD proposed spending $30 million to accelerate and shorten

the HOPE SF housing program schedule from 20 years to 17 years,

the Mayor’s Budget Director’s presentation proposed

spending $80 Million on the same acceleration of HOPE SF. So which

is it: $30 million, or $80 million?

When you compare the two proposals side-by-side, it becomes clear that the Mayor and his various staff are throwing darts at the wall to set what will stick. And leading up to the November election, the proposals will likely keep being modified while they make this up as they go along.

You can almost count on two probabilities: 1) That the language in the official ballot measure will be completely vague and not itemize precisely or accurately how the bond will eventually be spent, and 2) That there will be a clause in the bond language giving the Mayor’s Office of Housing sole discretion over how the bond money will be spent.

Even

More “Leveraging”

Even

More “Leveraging”

The Mayor, his Budget Director, Kate Howard, and Olson Lee at MOHCD are using multiple forms of “leveraging” that when combined, are very worrisome.

Chasing “Alpha-”bet Soup: "Leveraging" IDF’s asnd COP’s

First, the Mayor plans to create an Infrastructure Financing District (IFD) to leverage an increment at Potrero and Sunnydale. The full PowerPoint presentation to the Mayor on February 3 notes that planed sources of revenue for housing in the pipleine includes creation of an IFD. IFD’s are Tax Increment Financing (TIF) financing structure without redevelopment. IFD’s are used as a strategy to leverage additional non-City resources. IFD revenues may only fund “public facilities” but cannot fund actual housing, except when facilities funded by an IFD demolish housing.

Second, the full PowerPoint presentation also reveals

the Mayor will increase revenues for housing in the pipeline by

issuing additional COP’s for HOPE SF. In addition to up to

$80 million from the November bond being proposed for HOPE SF,

an as-yet undisclosed amount of COP’s will be issued for

HOPE SF.

Second, the full PowerPoint presentation also reveals

the Mayor will increase revenues for housing in the pipeline by

issuing additional COP’s for HOPE SF. In addition to up to

$80 million from the November bond being proposed for HOPE SF,

an as-yet undisclosed amount of COP’s will be issued for

HOPE SF.

COP’s — Certificates of Participation — are a financing gimmick that the City of San Francisco developed to creatively bypass having to ask those pesky voters for approval at the ballot box to issue general obligation bonds (GOB), and to circumvent the maximum amount of GOB’s that can be issued simultaneously at any one time.

COP’s are generally based on lease agreements, with the borrower serving as the lessee and another entity serving as the lessor and the issuer of the bonds. Typically, COP’s require use of other City infrastructure assets pledged as collateral, a dangerous practice should the City default on repayment of the COP. COP’s are not considered to be “indebtedness” subject to California’s voter approval requirements governing general obligation bonds, despite the fact that they are funded from General Fund revenues. COP’s require repayment of both principal and interest on lease certificates, and, like general obligation bonds, can require interest payments nearly equal to the borrowed amount (e.g., a $100 million COP may tack on close to $100 million in debt service interest).

The Board of Supervisors are permitted to approve issuing COP’s with the stroke of their pens, without having to obtain consent of the voters. San Francisco has used issuing COP’s heavily for a variety of infrastructure financing, including the rebuild of Laguna Honda Hospital.

The

Off Balance-Sheet “Catalyst Fund Top Loss” Fund

The

Off Balance-Sheet “Catalyst Fund Top Loss” Fund

The Mayor’s January 15 press release also claimed that he would create a new investment fund to launch more affordable housing projects:

It is thought that the proposed “accelerator fund” is the “Catalyst Fund Top Loss” program. A “Findings and Recommendations” document prepared by the Mayor’s Housing Work Group 2014 reports that a “Housing Affordability Fund” — ostensibly separate and distinct from the Housing Trust Fund approved by voters in 2012, or within it — will be established via a public-private partnership.

The Housing Work

Group report states the accelerator fund will leverage limited

public dollars for housing by pursuing development of the Housing

Affordability Fund as an “off balance-sheet” fund. The

Housing Affordability Fund would target leveraging a public and

philanthropic investment at a rate of 4:1 or higher. Here comes

trouble.

The Housing Work

Group report states the accelerator fund will leverage limited

public dollars for housing by pursuing development of the Housing

Affordability Fund as an “off balance-sheet” fund. The

Housing Affordability Fund would target leveraging a public and

philanthropic investment at a rate of 4:1 or higher. Here comes

trouble.

Investopedia.com’s summary that explains off balance-sheet investing reports:

Investopedia notes that common forms of off-balance sheet (OBS) financing include operating leases and partnerships. Investopedia goes on to note:

“Partnerships

is the way Enron hid its liabilities. When a company engages

in a partnership, even if the company has a controlling interest,

it does not have to show the partnership’s liabilities

on its balance sheet, again resulting in a cleaner balance sheet.

… The problem investors encounter when analyzing a company’s

financial statements is that many of these OBS financing agreements

are not required to be disclosed at all, or they have partial

disclosures, which are very minimal and do not provide adequate

data required to fully understand a company’s total debt.

Even more perplexing is that these financing arrangements are

allowable under current accounting rules, although some rules

govern how each can be used. Because of the lack of full disclosure,

investors need to determine the worthiness of the reported statements

prior to investing by understanding any OBS arrangements.

“Partnerships

is the way Enron hid its liabilities. When a company engages

in a partnership, even if the company has a controlling interest,

it does not have to show the partnership’s liabilities

on its balance sheet, again resulting in a cleaner balance sheet.

… The problem investors encounter when analyzing a company’s

financial statements is that many of these OBS financing agreements

are not required to be disclosed at all, or they have partial

disclosures, which are very minimal and do not provide adequate

data required to fully understand a company’s total debt.

Even more perplexing is that these financing arrangements are

allowable under current accounting rules, although some rules

govern how each can be used. Because of the lack of full disclosure,

investors need to determine the worthiness of the reported statements

prior to investing by understanding any OBS arrangements.

Other documents on

the Internet indicated that the term “top loss” refers

to the liability structure in the mix of debt and equity in investment

fund activities. The documents explain that various:

Other documents on

the Internet indicated that the term “top loss” refers

to the liability structure in the mix of debt and equity in investment

fund activities. The documents explain that various:

Given San Francisco’s already overextended reliance on general obligation bond financing, to some observers it appears that the Mayor’s Housing Work Group is well aware of the risks of off balance-sheet funding schemes, may already be anticipating losses to the Housing Affordability Fund, and determined that a “top loss” layer of funding may be necessary in such a public-private partnership.

Housing-to-Come Pipeline

The Mayor’s

January 15 press release also claimed he would expand the City’s

pipeline of middle-class housing:

The Mayor’s

January 15 press release also claimed he would expand the City’s

pipeline of middle-class housing:

How can a Public Lands for Public Good program develop housing for San Francisco’s middle-class, since this conflicts with Olson Lee’s claim that the City doesn’t even have a program to build middle-income rental housing? What is this? More smoke and mirrors from the Mayor’s office?

Of note, MOHCD staff

members Kate Hartley and Olson Lee; the Mayor’s Budget Director,

Kate Howard; the Mayor’s Deputy Chief of Staff, Jeff Buckley;

and the Mayor were scheduled to meet on February 3, 2015 to discuss

the pipeline of housing projects in the City. Ms. Howard’s

PowerPoint presentation discussed above reveals other worrisome

details.

Of note, MOHCD staff

members Kate Hartley and Olson Lee; the Mayor’s Budget Director,

Kate Howard; the Mayor’s Deputy Chief of Staff, Jeff Buckley;

and the Mayor were scheduled to meet on February 3, 2015 to discuss

the pipeline of housing projects in the City. Ms. Howard’s

PowerPoint presentation discussed above reveals other worrisome

details.

First, Howard’s February 3 housing pipeline presentation noted that fully 20% of affordable housing units in the pipeline will be set aside for the homeless. It’s too bad there’s not a matching 20% being set aside for middle-class housing.

Will the Mayor tell voters — honestly — that his $250 million bond measure in November will steer fully 20% the bond to our homeless?

In addition to MOHCD director Olson Lee having noted during the Port of San Francisco headquarters meeting on February 26, 2015 that the City doesn’t have a program to build middle-income rental housing, Ms. Howard’s presentation notes that “gaps” in housing opportunities in the housing pipeline includes a gap for middle-income housing. Another identified “gap” involves the continued demand for more affordable housing production.

Apparently, the Mayor

has no plan to address either gap, and bemoans the fact that the

Sunnydale public housing redevelopment will not be completed for

17 to 20 years. He meanwhile bemoans nothing about how many years it will take to develop

middle-class housing.

Apparently, the Mayor

has no plan to address either gap, and bemoans the fact that the

Sunnydale public housing redevelopment will not be completed for

17 to 20 years. He meanwhile bemoans nothing about how many years it will take to develop

middle-class housing.

Pitting Pensioners Against Low-Income Housing

The Mayor’s January 15 press release also claimed he plans to tap the City employee’s retirement fund for $100 million to increase down payment loans for moderate- and middle-income San Franciscans:

First, three months

after the Mayor’s premature claim he plans to tap the retirement

fund to invest in downpayment loans, the San Francisco Retirement

Board still hasn’t formally considered approving pension

funds for potentially risky and highly illiquid loans, or approved

of such investment of pension fund assets, pitting pensioners

relying on their pensions against low-income people seeking housing.

First, three months

after the Mayor’s premature claim he plans to tap the retirement

fund to invest in downpayment loans, the San Francisco Retirement

Board still hasn’t formally considered approving pension

funds for potentially risky and highly illiquid loans, or approved

of such investment of pension fund assets, pitting pensioners

relying on their pensions against low-income people seeking housing.

Second, doing basic math, 150 families each year for the next 10 years suggests that 1,500 families splitting $100 million would each receive loans of approximately $66,666.67. Notably MOHCD had concluded that the $100,000 maximum loan amount for its first-responder DLAP program was insufficient, and needs to be increased to $200,000 loans. So how are $66,666 loans going to help?

The pension fund is there to pay pensions to former City employees. Using it for downpayment loan schemes is simply wrong, and an unwise investment.

Show Us the Money

The Mayor and City

Hall owe a full accounting of how MOHCD is spending money in the

housing trust fund (HTF).

The Mayor and City

Hall owe a full accounting of how MOHCD is spending money in the

housing trust fund (HTF).

For starters, the MOHCD annual report notes on page 2 that the HTF has received $42.8 million between July 1, 2013 and July 1, 2014, and will receive another $25.6 million on July 1, 2015. During its first three years the HTF will have received a total of $68.4 million. What was it spent on?

Next, considering that the Mayor approved in 2014 issuing bonds against HTF revenues as collateral, the “doubling” of revenue to the HTF in Years 2 and 3 to $50 million each year (a $25 million increase each year by issuing bonds against the Housing Trust Fund), that suggests the fund has been leveraged to a total of $118.4 million. What is that $118.4 million being spent on?

MOHCD’s annual report says $3,256,000 of the first $20 million in FY 2013 was spent “defining and launching programs,” but the annual report didn’t indicate whether the remaining almost $17 million was spent in its first year. This corresponds to a records request placed with the City Controller; the Controller indicated that as of February 18, 2014 fully 92.8 percent — $17.5 million — of the total $20 million transferred from the General Fund to the Housing Trust Fund for its first year of funding remained unencumbered (unspent) fully nine months into the then-current 2013-2014 fiscal year.

Interestingly, MOHCD’s

annual report admits

that only four First Responder loans were issued between July

1, 2013 and June 30, 2014, not the ten $100,000 loans voters had

been told would be issued. Eugene Flannery in MOHCD has refused

to respond to public records requests about what happened to the

remaining six loans for the first year of the program, and has

refused to provide any information about the number of down payment

loans that may have been issued — let alone any information

about how many first responders may have applied — during

the second year of the first-responders loan program.

Interestingly, MOHCD’s

annual report admits

that only four First Responder loans were issued between July

1, 2013 and June 30, 2014, not the ten $100,000 loans voters had

been told would be issued. Eugene Flannery in MOHCD has refused

to respond to public records requests about what happened to the

remaining six loans for the first year of the program, and has

refused to provide any information about the number of down payment

loans that may have been issued — let alone any information

about how many first responders may have applied — during

the second year of the first-responders loan program.

It is not yet known whether ten $100,000 loans were made available in Year 2 or whether the program was changed to issue only five $200,000 loans, and it is also not known whether any police officers or firefighters snapped up the chance to obtain an interest-free $200,000 loan. Flannery has also failed to respond to a records request involving how many down payment loans were issued to non-first responders in a separate program created when voters approved establishing the Housing Trust Fund.

Burned (More Than) Once, Twice Shy

As I reported in April 2014, Harvey Rose — the Board of Supervisors Budget and Legislative Analyst — weighed in, however unintentionally, on performance of the Mayor’s Office of Housing and Community Development.

In February 2014, Rose submitted an analysis to the Board of Supervisors who were considering a $2 million increase to an initial proposal to divert $2.5 million from the City’s General Fund Reserve account to fund a new “Non-Profit Rental Stabilization Program,” increasing the proposal to $4.5 million.

Rose noted such a

decision might be premature, since the criteria for awarding stabilization

funds to individual nonprofit organizations, any limitations on

use of the funds, limits on the amount of funds to be awarded,

and “administrative and selection procedures” had not

yet been decided, and won’t be until after a planned report

from a so-called “Nonprofit Displacement Work Group”

is completed and presented, presumably on April 11, 2014.

Rose noted such a

decision might be premature, since the criteria for awarding stabilization

funds to individual nonprofit organizations, any limitations on

use of the funds, limits on the amount of funds to be awarded,

and “administrative and selection procedures” had not

yet been decided, and won’t be until after a planned report

from a so-called “Nonprofit Displacement Work Group”

is completed and presented, presumably on April 11, 2014.

Rose claimed it was simply a “policy matter” for the Board to consider increasing the raid of the General Fund Reserve account, reducing General Fund reserves from $44 million to just $40 million, which the San Francisco Examiner later creatively titled a news article as being a “gift” to the City, albeit being a raid of the City’s reserve coffers, not a philanthropic “gift.”

Rose claimed this, after first admitting that way back in 2000, the Board of Supervisors had approved two ordinances to appropriate $1.5 million from the City’s General Fund Reserve to provide rent subsidies to nonprofit arts organizations in immediate danger of being evicted or displaced by rent increases.

Rose reported on February 26, 2014, that the Mayor’s Office of Housing and Community Development claims overall expenditures, including administrative costs of the arts rental assistance program, are “not currently available.”

Wait! What? The Mayor’s

Office of Housing has no information available at all about how

$1.5 million may (or may have not) have been spent over a 14-year

period?

Wait! What? The Mayor’s

Office of Housing has no information available at all about how

$1.5 million may (or may have not) have been spent over a 14-year

period?

Apparently, Mr. Brian Cheu, Director of Community Development in the Mayor’s Office of Housing and Community Development advised Rose’s team that “approximately” 12 grants for rental subsidies were provided under the arts rental assistance program during an unspecified time frame. More apparently, “approximately” was as close as Cheu could get, which Rose appears to have accepted and the Board of Supervisors appear to have later swallowed at face value.

A million-and-a-half dollars vanish over 14 years, and nobody knows where, or how?

Rose’s report provided to the Board of Supervisors noted that Mr. Cheu in the Mayor’s Office of Housing and Community Development had advised Rose that there was also “no information” about the $500,000 portion of the rent subsidies to nonprofit service and advocacy organizations.

Surprisingly, Rose uncharacteristically included in his report a damning statement, saying, “… such that it appears that the City may have never implemented this portion of the program.” This suggests MOHCD couldn’t account for $2 million in funding entrusted to it.

If MOHCD can’t

accurately account for $2 million of its funding, why do voters

believe MOHCD will be a judicious fiduciary steward of $1.5 billion

in Housing Trust Funds, plus $250 million in a bond measure in

November 2015 and $100 million of funding from the retiree’s

pension fund if the Employee’s Retirement Services board

of directors grants approval to tap the retirement fund at the

Mayor’s whim, and various “leveraging” schemes

being advanced at City Hall, including IFD’s, COP’s,

and “off balance sheet” top-loss schemes?

If MOHCD can’t

accurately account for $2 million of its funding, why do voters

believe MOHCD will be a judicious fiduciary steward of $1.5 billion

in Housing Trust Funds, plus $250 million in a bond measure in

November 2015 and $100 million of funding from the retiree’s

pension fund if the Employee’s Retirement Services board

of directors grants approval to tap the retirement fund at the

Mayor’s whim, and various “leveraging” schemes

being advanced at City Hall, including IFD’s, COP’s,

and “off balance sheet” top-loss schemes?

How can San Francisco have a plan to allocate fully 20% of the housing in the development pipeline for the homeless, but not have any money — or a plan — for building housing for the middle class?

As I asked in April 2014, over the next six years as the City drags its heels on the Housing Trust Fund, how many more thousands of San Franciscans will no longer be living in the City displaced by the bait and switch in the Mayor’s “affordability agenda” (and his new “sharing prosperity agenda”), given the glacial inaction in — and the ineptness of — the Mayor’s Office of Housing?

Voters have been warned: If for no other reason, given

the absence of an oversight board or commission monitoring either

the operations of the Mayor’s Office of Housing and Community

Development or its full Housing Trust Fund, vote against this

$250 million bond measure come November.

Top

Monette-Shaw is an open-government accountability advocate, a

patient advocate, and a member of California’s First Amendment

Coalition. He received the Society of Professional Journalists-Northern

California Chapter’s James

Madison Freedom of Information Award

in the Advocacy category in March 2012. Feedback: monette-shaw@westsideobserver.